The 2024 Pasadena Real Estate Market Forecast

2024 Pasadena real estate market forecasting involves considering various factors including current trends, economic indicators, housing supply and demand dynamics, and potential external influences. Here’s a speculative forecast based on historical data and plausible future scenarios:

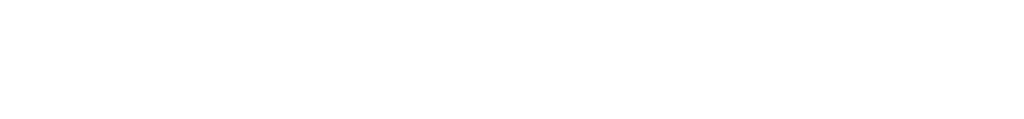

Continued Price Appreciation

Over the past few years, Pasadena has experienced steady price appreciation in its real estate market. This trend is likely to continue into 2024, albeit at a more moderate pace compared to previous years. Factors such as low interest rates, a strong job market, and limited housing inventory will contribute to ongoing price growth.

Shift Towards Suburban Living

The COVID-19 pandemic accelerated a trend towards suburban living as people sought larger homes with more outdoor space. This trend is expected to persist in 2024, with Pasadena attracting buyers looking for spacious properties with yards and gardens. As a result, single-family homes in suburban neighborhoods may see increased demand and higher prices.

Impact of Interest Rates

The direction of interest rates by the fed will play a significant role in the 2024 Pasadena real estate market. If interest rates remain low or experience only modest increases, this will support continued homebuying activity and price appreciation. However, a significant and rapid increase in interest rates could dampen buyer enthusiasm and slow down the market.

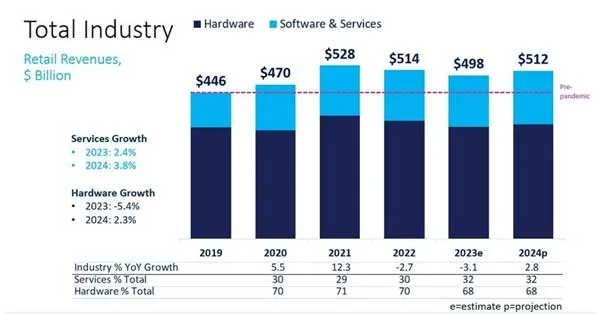

Tech Industry Growth

Pasadena’s proximity to tech hubs like Silicon Beach (Santa Monica) and its vibrant startup scene could attract tech professionals looking to settle in the area. As tech companies continue to expand and hire talent, there may be increased demand for housing in Pasadena, particularly among younger, well-paid professionals.

Supply Constraints

Limited housing inventory has been a persistent challenge in Pasadena and many other parts of California. Despite ongoing construction efforts, supply may not keep pace with demand in 2024, putting upward pressure on prices. Sellers may continue to hold off on listing their homes due to uncertainty or lack of suitable replacement options, further exacerbating the supply shortage.

Potential Economic Headwinds

While the overall economic outlook is positive, unforeseen events such as a global economic downturn, geopolitical tensions, or natural disasters could negatively affect the Pasadena real estate market. Buyers may become more cautious, leading to decreased demand and a slowdown in price growth.

2024 Pasadena Real Estate Market Forecast: The Bigger Picture

In summary, the Pasadena real estate market in 2024 is likely to see continued price appreciation, strong demand for suburban properties, and ongoing supply constraints. Factors such as interest rates, tech industry growth, government policies, and external economic conditions will all influence market dynamics. Despite potential challenges, Pasadena’s desirable location, strong community amenities, and quality of life are expected to sustain its appeal among homebuyers and investors. Go here to learn more about Pasadena real estate news.